how to calculate stock up rate

At what rate the price will grow. Estimate your pasture inventory Start with estimating your pasture inventory in each pasture.

Step 2 Calculate The Cost Of Equity Stock Analysis Cost Of Capital Step Guide

Keep in mind that equity is not just comprised of common stocks.

. This takes your total investment to 4000. Multiply the difference to the 1Nth power. Total Profit or Loss Total Buy Price - Total Sell Price.

Write out the formula. Substituting the values in the formula we get 33000500000100 66 Therefore Mark owns roughly 7 of XYZ. For a company the cost of goods sold ie COGS is a yardstick for the production costs of services and goods.

Percent change Growth rate x 100 How to calculate the average growth rate over time. Ownership Percentage of Mark Number of common stocks owned by Mark Total number of Outstanding shares 100. Follow these steps to calculate the average annual continuous growth rate.

Your estimated annual interest rate. Take the value of the stock at the beginning of the year and subtract it from the value at the end of the year to find the difference in value. Average Inventory 4341 billion.

Use this formula for growth rate calculation. On each share you made a profit of 8 12-4. Stock Turnover Ratio is calculated using the formula given below.

The intrinsic value of a stock can be found using the formula which is based on mathematical properties of an infinite series of numbers growing at a constant rate. Multiply by 100 to get the. Formula for Rate of Return.

Access the price data and financial report of you stock as suggested in the above article. Convert to a percentage. Multiply that by 1000 shares and your total profit is 8000.

It is important to calculate your safety stock carefully because while too little stock will result in shortages too much stock will inflate your inventory costs. Calculating stock returns on Python is actually incredibly straightforward. Following is how you would do the calculation assuming the commission fee is 0.

Then raise this to the power of 1 divided by the number of years you held the investment. NS is the number of shares SP is the selling price per share BP is the buying price per share SC is the selling commission BC is the buying commission. If you wanted the percentage of Products that had more than 100 items in Stock use.

Interest rate variance range. By using the pct_change. Total Sell Price 100 6 600.

For example if you have an investment that was worth 500 at the beginning of 2020 and it is worth 650 at the end of 2021 two years total its basic growth rate becomes 650 - 500 500 030 which is 30 percent. Write out the formula. How to calculate the price of a stock.

Future pricecurrent price1 years 1. The formula used for the average growth rate over time method is to divide the present value by the past value multiply to the 1N power and then subtract one. You can use the stock growth rate formula to calculate this.

As per the above your capital gains amount to 8000. The average stock needs to be computed as firms might carry lower or higher stock levels at. SUM CURRENT_STOCK REORDER_LEVEL 100 COUNT.

For example if you purchase 100 shares of a stock at a price of 5 and sold it for 6 your profit will be 100. Expected price of dividend stocks One formula used to value dividend stocks is the Gordon constant growth model which assumes that a stocks dividend will continue to grow at a constant rate. It can be calculated using the below steps.

Calculate carrying capacity in each pasture Once you have estimated pasture inventory calculate total carrying. The Stock Calculator is very simple to use. SUM CURRENT_STOCK 100 100 COUNT If you wanted the percentage of Products that had Stock that was below its reorder level assuming a Column in the Products Table named REORDER_LEVEL use.

How to Calculate Stocking Rate and Carrying Capacity Step 1. Profit P SP NS - SC - BP NS BC Where. Range of interest rates above and below.

Total Buy Price 100 5 500. Calculate stock returns manually by using the shift method to stack the stock price data so that and share the same index or. Calculating the rate of return for XYG is as follows.

Find the difference between the present and past value. Take the percentage total return you found in the previous step written as a decimal and add 1. You can use a stock growth rate calculator to help you with this figuring if need be.

Average Inventory 4305 billion 4378 billion 2. To arrive at this figure the stock calculator divides the total return on investment by the total original investment and then multiplies that result by 1N where N is the number of years the investment is held. The Stock Calculator uses the following basic formula.

Average Inventory Inventory at Beginning of the Year Inventory at End of the Year 2. Intrinsic value of stock D. This is because you originally invested 4000 and sold the shares for 12000 five years later.

If you would like to save the current entries to the secure online database tap or click on the Datatab select New Data Record give the data record a name then tap or click. Ad Calculate profit or loss from buying and selling shares of stock.

What Is Cap Rate And How To Calculate It Infographic What Is Cap Real Estate Infographic Investment Property For Sale

/dotdash_INV_final_Calculating_CAPM_in_Excel_Know_the_Formula_Jan_2021-01-547b1f61b3ae45d7a4908a551c7e7bbd.jpg)

What Is The Formula For Calculating Capm In Excel

Anticipatory Inventory Meaning Importance Advantages And More Financial Management Accounting And Finance Inventory

Common Stock Formula Calculator Examples With Excel Template

:max_bytes(150000):strip_icc()/dotdash_Final_Calculating_the_Equity_Risk_Premium_Dec_2020-01-1ff6e59964b9408d9ac7d175f8ad1292.jpg)

Calculating The Equity Risk Premium

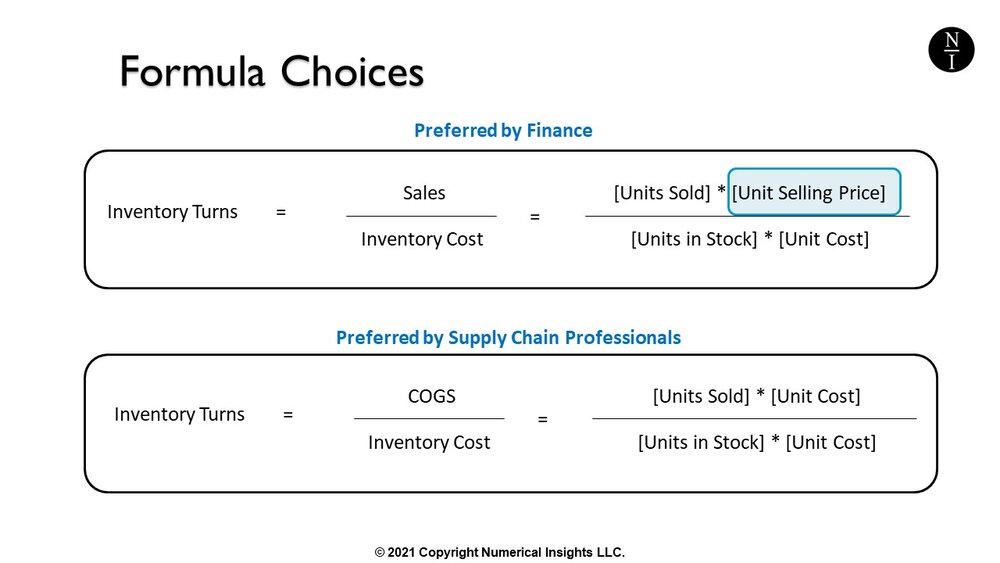

What Is Inventory Turnover Inventory Turnover Formula In 3 Steps

Profitability Index Pi Or Benefit Cost Ratio Money Concepts Investing Stock Analysis

Rate Of Return Formula Calculator Excel Template

Formula To Calculate Inventory Turns Inventory Turnover Rate

Pin On Basic Concepts In Economic Business And Finance

Irr Internal Rate Of Return Definition Example Financial Calculators Balance Transfer Credit Cards Cost Of Capital

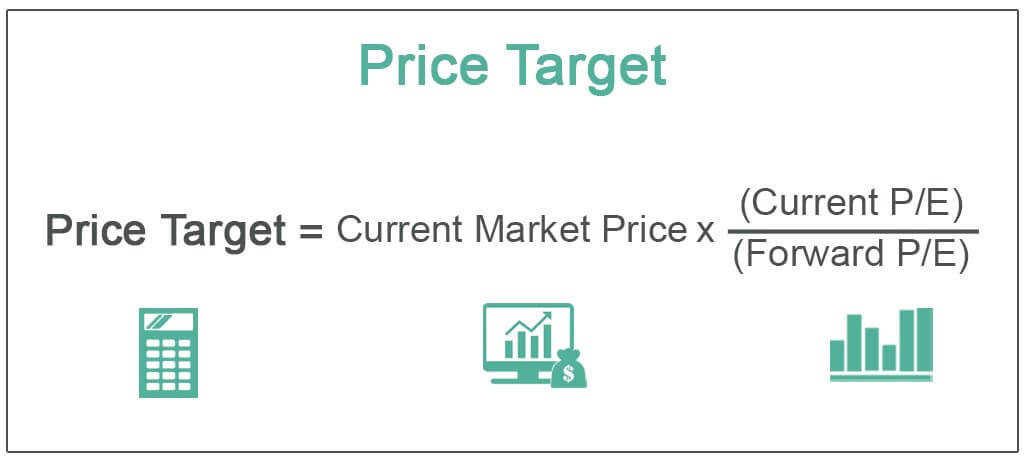

Price Target Definition Formula Calculate Stocks Price Target

Discount Rate Formula How To Calculate Discount Rate With Examples

Best 5 High Return Shares 2021 High Cagr Stocks In 2021 Stocks With Cagr More Than 50 Investing In Stocks Stock Analysis Stock Market

Stock Price Calculator For Common Stock Valuation Debt Calculator Mortgage Payment Calculator Online Calculator

Intrinsic Value Formula Example How To Calculate Intrinsic Value Intrinsic Value Intrinsic Company Values